How To Get 8%+ Growth In Your First Year Buying New Property

How We Help Our Clients

How We Help

Our Clients

Develop a strategy based on your financial situation, including income, assets, and liabilities. We work with you to set clear goals, ensuring your property investments align with long-term financial objectives and creating a strong foundation for your wealth-building journey.

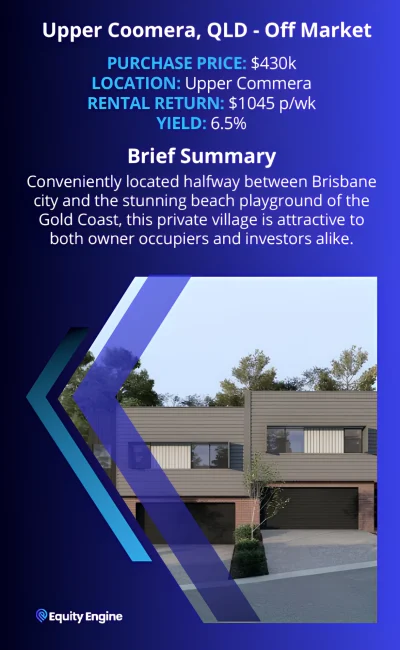

We identify and secure high-yielding properties within your budget, leveraging our expertise to find off-market opportunities. Each purchase is carefully selected to fit your strategy, maximising returns and equity growth over time.

We continually monitor your portfolio, assessing growth trends and market conditions. This proactive approach ensures we seize opportunities for your next property purchase, allowing you to capitalise on equity and maximise long-term growth.

Who is Equity Engine?

Who is

Equity Engine?

Years of combined

Experience

Property

Transacted

Properties Purchased

for clients

Why Most Fail At Property Investing

There’s a reason most people fail when it comes to property investing.

Having the right plan and guidance makes investing in property a breeze and takes the guesswork and uncertainty out of it.

Lack of a Clear Strategy

Many investors jump into property without a well-defined strategy or understanding of their long-term financial goals. They may buy based on emotion, trends, or hearsay instead of aligning their purchases with a carefully crafted investment plan.

Poor Market Research

Failing to properly research the market and understand key factors like location growth potential, rental demand, and property cycles can lead to bad investment decisions. Many investors overlook vital due diligence or rely too heavily on opinions instead of data-driven insights.

Underestimating Costs

Hidden expenses such as maintenance, taxes, interest rate changes, and vacancy periods often catch investors off guard. Without accounting for these costs, what initially seems like a good deal can become a financial burden.

Over-Leveraging

Some investors stretch their finances too thin by taking on too much debt or leveraging themselves with risky loans. When markets shift, or interest rates rise, they may struggle to meet their obligations, leading to financial strain or forced sales.

Ignoring Long-Term Wealth Building

Many investors are focused on short-term gains, expecting quick profits from flipping properties or market timing. Real estate success typically comes from a long-term approach, where wealth builds through compounding capital growth and smart portfolio management.

The Vision 10 Wealth Plan

Your Path to Financial Independence

Our Vision 10 Wealth Plan is designed to give you a clear roadmap to financial independence within 10 years through smart property investments. When you partner with us, you’re backed by a team of dedicated property experts committed to making your financial dreams a reality.

Discovery & Goal Setting

We begin with an in-depth consultation to understand your financial goals, lifestyle aspirations, and current financial position. Together, we define a clear vision for where you want to be in 10 years, setting the foundation for your personalised property investment plan.

Tailored Strategy Creation

Our team of property experts crafts a bespoke 10-year property investment strategy that aligns with your financial goals. This includes identifying the right property types, markets, and timing to maximise capital growth and rental yields while minimising risks. We focus on new properties that offer tax advantages and high-growth potential.

Portfolio Construction

With your strategy in place, we handpick the best investment properties that fit your plan. We ensure that each property strengthens your portfolio, whether for capital appreciation, cash flow, or a combination of both. Our comprehensive market research and off-market opportunities give you access to the best investments.

Finance & Structure Optimisation

Our financial team works with you to secure the most advantageous loan structures, minimising costs and maximising your borrowing capacity. We also set up the right ownership structures to protect your assets and optimise tax benefits, ensuring your portfolio is set up for long-term success.

Ongoing Portfolio Management

Your Vision 10 Wealth Plan doesn’t stop at purchasing properties. We provide continuous management, reviewing your portfolio regularly to ensure it’s performing according to plan. Our experts adjust the strategy when needed, responding to market changes or personal circumstances to keep you on track toward financial independence.

Achieving Financial Independence

You’ll build a high-performing property portfolio over the next 10 years with our support, guidance, and expertise. We’ll be by your side every step of the way, helping you make informed decisions that grow your wealth and bring you closer to the financial independence you desire.

The Vision 10 Promise

When you join The Vision 10 Wealth Plan, you’re not just getting a service — you’re getting a team of dedicated property professionals who will help you achieve your dream of financial independence through property.

OUR $10K CASHBACK PROMISE

Save $25K and Receive $10k Cash Back

We began as a traditional buyers agency, working closely with investors and charging fees between $15,000 and $25,000 per property. But along the way, we saw an opportunity: sellers were already paying real estate agents a commission. That got us thinking—what if we bypassed the selling agent entirely and redirected that commission to cover our clients’ fees?

That’s exactly what we did. Now, as a buyers brokerage, we eliminate client fees by leveraging the seller’s commission. This approach saves our clients an average of $25,000 per property, giving them more flexibility to allocate those savings toward deposits, settlement costs, or other investments.

And it doesn’t stop there. To make things even better, if the property we secure for you doesn’t achieve at least 8% growth in its first 12 months, we’ll pay you $10,000.

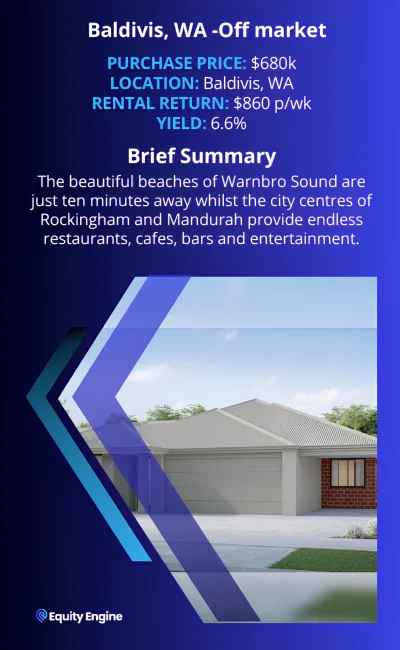

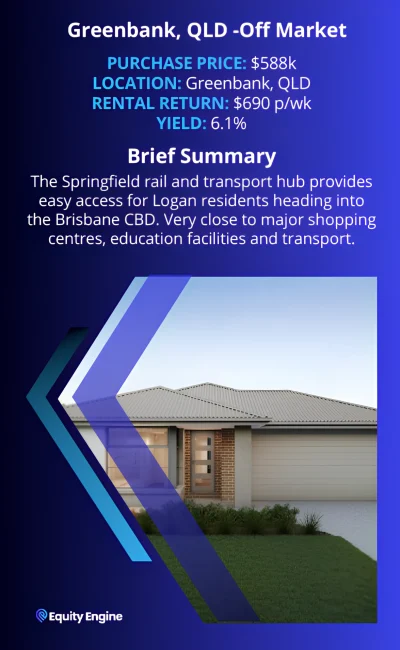

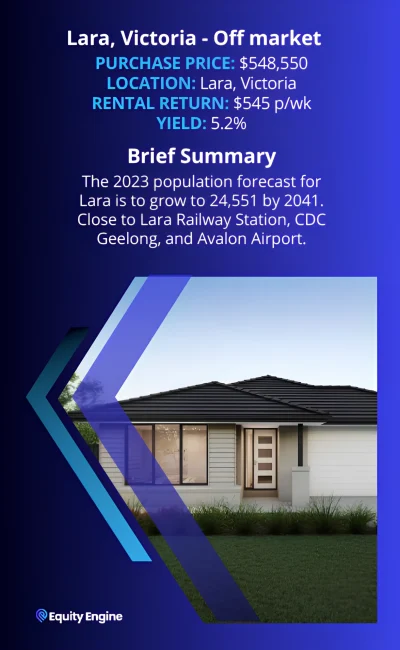

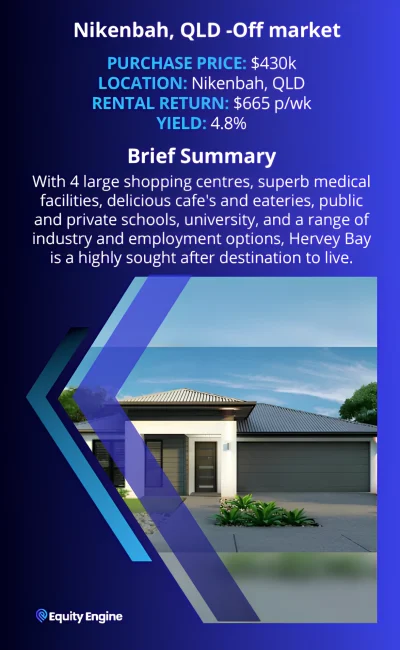

RECENT PURCHASES